“

”Markets in Focus

Timely analysis of market moves and sectors of opportunity

Jan. 29, 2024: Don’t fear all-time highs

Key points

-

This is a still narrow market, but it’s no longer just the “Magnificent Seven” versus the other 493 stocks in the S&P 500 Index. Worth noting: 149 companies have outperformed the S&P 500 year to date.

-

What recession? Last week’s fourth-quarter GDP showed a sizeable acceleration in economic growth in the second half of 2023. So don’t expect the Fed to start cutting interest rates in March.

-

Things to watch: Earnings. Small caps. Industrials focused on infrastructure, reshoring and defense (especially advanced electronics and software). Emerging markets, including China (but be careful).

Skepticism persists as major U.S. equity indices continue to push all-time highs, but Matt Orton sees reason for optimism about the opportunities of a gradually broadening market.

“I don’t know if the market is as narrow as many people think,” said Orton, CFA, Chief Market Strategist at Raymond James Investment Management. “When you look at earnings season, you’ve had a number of companies be rewarded for exceeding expectations and providing upbeat management commentary because they underperformed the market last year. I get the sense that investors are finally being a little bit more discerning and trying to find some new opportunities. That, to me, is very encouraging.”

Economic data remains quite strong, and while it’s highly likely that it weakens in coming quarters, Orton said the overall backdrop remains positive. Investor sentiment has flipped after being too pessimistic for the past year, and positioning has already followed that change. While this is indeed a narrow market, it’s no longer just the “Magnificent Seven” – the seven mega-cap stocks that dominated returns in 2023 – versus the other 493 stocks in the S&P 500 Index. Rather, Orton said it’s about finding where fundamentals are finally intersecting with expectations. Most of the market was in an earnings recession in 2023, while many tech giants started to see an inflection as they returned to earnings growth. That inflection is starting to happen across other pockets of the market, which is why Orton said he remains optimistic that we likely start to see a gradual broadening over the coming months. There are many companies that have already reported strong earnings results up and down the market capitalization spectrum, serving as a reminder why he has continued to reiterate the importance of being selective. In fact, there are 149 companies that have outperformed the S&P 500 year to date as of Jan. 26, 2024, according to Bloomberg.

So rather than fear periods of consolidation, which seem likely in the near term given the overbought nature of growth stocks and a normalization of expectations for interest rate cuts from the U.S. Federal Reserve (Fed), he said investors should see these periods as opportunities to make changes to portfolios and strategically check some items off their shopping lists.

“All-time highs are not something to fear – especially with a solid economic backdrop,” Orton said. “Instead, new highs should be used to ask whether your asset allocation is set up for success as the character of the bull market inevitably evolves.”

What could lead to short-term choppiness or consolidation?

The most immediate catalyst is earnings. This week will be busy with four of the Magnificent Seven reporting results, with those results playing an outsized role in shaping overall index expectations. Six of the seven are in aggregate expected to report year over year earnings growth of 53.7% for the fourth quarter. (The seventh, a leading electric vehicle manufacturer, has underperformed the index year to date.) Excluding these six companies – also known as the “Super Six” – the blended earnings decline for the remaining 494 companies in the S&P 500 would be -10.5%. So there’s clearly a lot riding on their results, but it’s also worth pointing out that the bar is set very low for the rest of the index’s constituents.

The Fed could also inject some volatility into the market as the Federal Open Market Committee (FOMC) wraps up its January meeting on Wednesday. The fall in inflation has surprised the Fed, but the central bank appears to have little appetite for growth to remain consistently above trend. This suggests that a growth scare or inflation undershoot may be necessary for the FOMC to meet the market’s more aggressive expectation of six 25-basis point cuts this year.

Why the market rally can broaden from here

One of the problems with the “everything” rally at the end of last year is that many stocks that had no business rallying based on fundamentals were bid up, Orton said. That is being unwound right now, likely pressuring the returns for the S&P 500® Equal Weight Index. Earnings will further lead to dispersion, and results for the 494 stocks outside of this year’s six top performers haven’t been too bad. The blended earnings decline for the S&P 500 currently stands at -1.4%, which is actually substantially ahead of the expectations of -10.5% (though none of the Super Six have reported yet). We’re seeing increasing new highs and lows across sectors in the Russell 3000® Index, which Orton said is encouraging from a breadth perspective. Also, we’re seeing outsized moves for companies that have reported positive results and followed through with upbeat management commentary. This reflects the opportunities that exist across the market of stocks and reinforces the importance in being selective, Orton said.

The continuation of positive economic news also corroborates Orton’s view over the past year that we’re not heading into recession. Last week’s gross domestic product (GDP) report for the fourth quarter showed a sizeable acceleration in economic growth in the second half of 2023, as the economy grew 3.3% quarter over quarter on a seasonally adjusted annual rate in the fourth quarter on the back of a 4.9% pace in the third quarter. The core Personal Consumption Expenditures (PCE) Price Index also came in right at expectations despite this strong growth.

“That said, I still believe the market’s pricing around a March rate cut looks offsides,” Orton said. “More normalization needs to take place.”

The recent easing in financial conditions and signs of economic resilience afford the FOMC some time to judge whether inflation is durably converging to its 2% target. Consequently, Orton expects the Fed to take a slow-moving, cautious approach to reducing rates. A less deep, less rapid cutting cycle seems most likely given the economic backdrop, he said.

Reasons to watch small caps and China

The performance of the market this year provides a reminder of why it will be increasingly more difficult to just own the indices and, thus, why selectively matters more and more. There has been a split in the Magnificent Seven: The Super Six are responsible for 75% of the market gains year to date versus 58% for the Magnificent Seven. With a busy earnings calendar for mega-cap stocks this week, we’ll see which ones can keep the upward momentum going. That said, Orton said he would be ready to use any overreactions opportunistically and would pay attention to developments in a few areas.

-

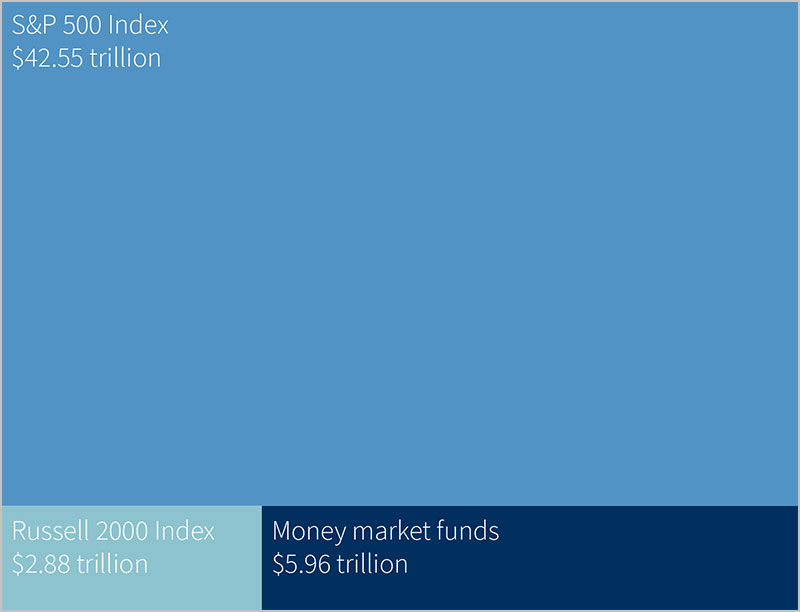

Position for broadening in small caps. It’s unclear whether small caps corrected enough to fully work off the extremely overbought conditions following the Russell 2000® Index’s best December on record, but we saw a return to outperformance relative to large caps last week, and earnings reports will start to pick up in the coming weeks. If investors are more accepting of the soft landing narrative, we should start to see more life down the market-cap spectrum, Orton said. Small-cap valuations remain attractive, and he expects to start seeing an earnings inflection over the next two quarters that could provide the catalyst for upside. He also said the record amount of cash on the sidelines can benefit small caps in particular. While the amount of cash in money market funds is small relative to the market cap of the S&P 500, it’s meaningfully larger than the market cap of the entire Russell 2000. Cash moving into small caps certainly could provide a real catalyst, and Orton hopes to start to see this if the fundamentals play out as expected. Now that we’re through regional bank earnings, maybe we’ll see optimism start to increase, he said.

-

Defense and infrastructure/reshoring. Industrials continue to perform well and there have been some big moves across the infrastructure complex as well as in aerospace and defense. Selectivity is critical here, Orton said, as we’ve seen a bifurcation in the results of defense companies. He said he prefers leaning into those that are levered to advanced electronics and software systems as this remains a key investment area going forward globally. Strong fourth-quarter GDP serves as a reminder of the positive economic backdrop, and recent headlines also point toward an acceleration in deploying funds that have been approved for key projects like new semiconductor capacity and other infrastructure development.

-

The China conundrum and diversifying with emerging markets. Following months of low conviction and lagging equity performance, the announcement of a deep cut to reserves at China’s central bank proved very effective in lifting investor spirits about Chinese equities. In fact, inflows into funds tracking both Asian emerging markets (EM) and China reached their second-highest level since 2000. The intersection of “so bad it’s good” and central bank action led to a 10% boost, but Orton said he is hesitant to chase the rally and would rather “rent” the upside using options than to own it outright. Given that skepticism, he said he would rather get exposure via European materials or luxury goods, two sectors with high exposure to China. He said he still prefers Asia ex-China from a long-term investment standpoint. Stronger national balance sheets, better monetary policy, and reduced reliance on foreign funding should provide tailwinds to most emerging markets and Orton prefers looking at EM ex-China. A weaker U.S. dollar also supports the case to be in emerging markets and Asia.

Money market funds could move the small-cap market

Total market cap comparison, in trillions of dollars, as of 1/24/24

Source: Bloomberg, as of 1/26/2024

What to watch

-

Earnings: 108 companies in the S&P 500 report, including four of the top six stocks and several other major companies.

-

Central banks: Watch for the FOMC’s rate decision Wednesday and the Bank of England’s on Thursday. The summary of opinions from the Bank of Japan might also provide more clues as to its thinking.

-

Data: Along with Friday’s jobs report, Thursday’s Eurozone Harmonised Index of Consumer Prices will be closely watched after the European Central Bank softened its language on inflation last week.

Risk Information:

Investing involves risk, including risk of loss.

Diversification does not ensure a profit or guarantee against loss.

Disclosures:

Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, or other expenses, which would reduce performance. Indexes are unmanaged. It is not possible to invest directly in an index. Any investor who attempts to mimic the performance of an index would incur fees and expenses that would reduce return.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature, or other purpose in any jurisdiction, nor is it a commitment from Raymond James Investment Management or any of its affiliates to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical, and for illustration purposes only. This material does not contain sufficient information to support an investment decision, and you should not rely on it in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and make their own determinations together with their own professionals in those fields. Any forecasts, figures, opinions, or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions, and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements, and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

The views and opinions expressed are not necessarily those of the broker/dealer or any affiliates. Nothing discussed or suggested should be construed as permission to supersede or circumvent any broker/dealer policies, procedures, rules, and guidelines.

Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Investing in small cap stocks generally involves greater risks, and therefore, may not be appropriate for every investor. The prices of small company stocks may be subject to more volatility than those of large company stocks.

International investing presents specific risks, such as currency fluctuations, differences in financial accounting standards, and potential political and economic instability. These risks are further accentuated in emerging market countries where risks can also include possible economic dependency on revenues from particular commodities or on international aid or development assistance, currency transfer restrictions, and liquidity risks related to lower trading volumes.

Definitions

Basis points (bps) are measurements used in discussions of interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.

Blended earnings combine actual results for companies that have reported earnings and estimated results for companies that have yet to report.

Breadth describes the relationship between the median and the mean of a market index. When a few data outliers result in a mean that is substantially larger (or smaller) than the median of the full data set, then the performance of the entire index is being driven by a “narrow” selection of companies. An index supported by “broad” market movements is one where the median is closer to the mean.

Conviction represents a market participant’s confidence in particular investments or the likelihood that particular outcomes will take place. High-conviction investments represent what participants consider to be their best bets for performance for a given outlook or period.

Core inflation is measured by the Personal Consumption Expenditures (PCE) excluding Food and Energy, Price Index, also known as the core PCE price index, is a measure of the prices that U.S. consumers pay for goods and services, not including two categories – food and energy – where prices tend to swing up and down more dramatically and more often than other prices. The core PCE price index, released monthly by the U.S. Department of Commerce Bureau of Economic Analysis, measures inflation trends and is watched closely by the U.S. Federal Reserve as it conducts monetary policy.

Dispersion refers to the range of outcomes in different areas of a financial market or to the potential outcomes of investments based on historical volatility or returns.

Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company’s profitability.

The Eurozone Harmonised Index of Consumer Prices is a composite measure of inflation in the Eurozone based on changes in prices paid by consumers in the European Union for items in a basket of common goods. The index tracks the prices of goods such as coffee, tobacco, meat, fruit, household appliances, cars, pharmaceuticals, electricity, clothing, and many other widely used products.

The Federal Open Market Committee (FOMC) consists of 12 members: the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents, who serve one-year terms on a rotating basis. The FOMC holds eight regularly scheduled meetings per year at which it reviews economic and financial conditions, determines the appropriate stance of monetary policy, and assesses the risks to its long-run goals of price stability and sustainable economic growth.

Fund flow is the net of all cash inflows and outflows into and out of a particular financial asset, sector, or index. It typically is measured on a quarterly or monthly basis. Investors and others look at the direction of fund flows for indications about the health of specific securities and sectors or the overall market.

Growth investing is a stock-buying strategy that focuses on companies expected to grow at an above-average rate compared to their industry or the market.

Investor positioning refers to assessments of whether professional investors are, on the whole, bullish or bearing on a particular security, industry, sector, market capitalization or other area of the market, as reflected by the extent to which they are invested in the area of the market in question.

The payroll report, officially known as the Employment Situation Summary, is a monthly U.S. Bureau of Labor Statistics (BLS) report tracking nonfarm payroll employment and the national unemployment rate, with data on changes in average hourly earnings, and job trends in public and private sectors of employment. The report is based on surveys of households and employers.

The “Magnificent Seven” refers to the seven largest stocks by market capitalization in the S&P 500 Index, as of Dec. 29, 2023. Collectively they made up more than 25% of the market capitalization of the entire index. They are Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

Market capitalization, or market cap, refers to the total dollar market value of a company’s outstanding shares of stock.

Market of stocks is a term market participants use when referring to the diversity of technical or other characteristics that may exist at any given time within the overall stock market. For example, the stock market as a whole may rise or fall on the fortunes of a small number of very large and thus very influential stocks. But within the broader market of stocks, there can be many companies with performance, risk, or opportunities that vary significantly from what market participants may find at the index level.

Mega-cap stocks are the largest publicly traded companies as measured by market capitalization. Generally, this refers to companies with market capitalizations over $200

billion.

An option is a financial instrument based on the value of underlying securities such as stocks. An options contract offers its buyers the opportunity to buy or sell — depending on the type of contract they hold — the underlying asset.

Overbought is a term used to describe a security or group of securities believed to be trading at a level above its or their intrinsic or fair value.

Reshoring describes the effort to bring manufacturing and other services back to the United States from overseas operations.

A soft landing is a cyclical slowdown in economic growth that avoids a recession.

The “Super Six” refers to a group of mega-cap stocks that have dominated S&P 500 returns in early 2024, as of Jan. 26, 2024. They are Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft and NVIDIA. Unlike the so-called Magnificent Seven, the Super Six excludes Tesla, which has not performed as well so far in 2024.

Indices

The S&P 500 Index measures change in stock market conditions based on the average performance of 500 widely held common stocks. It is a market-weighted index calculated on a total return basis with dividend reinvested. The S&P 500 represents approximately 80% of the investable U.S. equity market.

The S&P 500® Equal Weight Index is the equal-weight version of the S&P 500. It includes the same constituents as the capitalization-weighted S&P 500, but each company in the S&P 500 Equal Weight Index is allocated a fixed weight, or 0.2% of the index total at each quarterly rebalance.

The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 7% of the total market capitalization of the Russell 3000® Index.

The Russell 3000® Index measures the performance of the 3,000 largest U.S.-traded stocks, which represent about 96% of the total market capitalization of all U.S. incorporated equity securities.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor, or endorse the content of this communication.

M-491484 Exp. 5/29/2024

Jan. 22, 2024: Do not be seduced. 2024 is not 2023.

Key points

-

The broader “market of stocks” outperformed for the last six weeks of 2023, but – not surprisingly – has taken a bit of breather as the cap-weighted and megacap-dominated S&P 500 Index has surged in January.

-

Don’t be seduced into thinking 2024 will be a repeat of last year when only a handful of companies dominated. Watch for select opportunities in a broadening market fueled by improving corporate fundamentals and the redeployment of cash.

-

Areas to consider: Small caps. Fixed income. Emerging markets (but not China).

Not much could keep the market down last week with the S&P 500 Index hitting an all-time high more than two years in the making.

But market leadership was extremely narrow, noted Matt Orton, CFA, Chief Market Strategist at Raymond James Investment Management. That, he said, raises an important question and highlights the potential benefits of looking for rotation opportunities to help balance portfolios and manage risk.

A key driver last week was enthusiasm over artificial intelligence (AI), which was on full display at The World Economic Forum in Davos, Switzerland. It jumped even more (if possible) after a leading semiconductor manufacturer in Taiwan reported strong earnings and booming demand for high-end chips used in AI. Not even rising Treasury yields and some normalization of the expectations for an interest rate cut in March could hold down the technology sector, which has continued to lead the market higher.

“The key question now is will the rest of the market follow?” Orton said. “I continue to believe that it can – and must – start to outperform, but we’re only three weeks into the new year.”

The broader market of stocks outperformed for the last month and a half of 2023, so Orton said it’s not surprising to see it taking a breather relative to the cap-weighted indices so far in January.

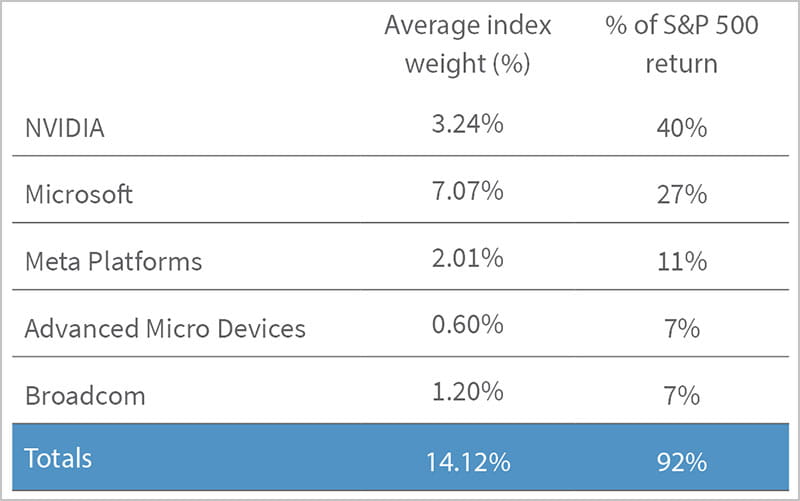

The concentration of returns this month also is quite extreme, with NVIDIA contributing more than 40% of the S&P 500’s year-to- date return through Jan. 19 (add in Microsoft and that goes to nearly 70%).

“That said, it’s way too early to throw in the towel and declare defeat for the average stock,” he said. “We’ve had some good news on the AI front that has helped propel many tech names higher, and I would note that biopharma enthusiasm has propelled healthcare to be one of the top-performing sectors so far this year.”

Extreme concentration

Top 5 stocks contributed more than 90% of S&P 500 returns in January

Source: Bloomberg, data as of 12/29/23 through 1/19/24.

Otherwise, for the broader market, we’ve really only seen earnings results from the financials, which haven’t been very inspiring (nor did Orton expect them to be). Things start to pick up this week with a number of consumer bellwethers reporting as well as many large aerospace and defense companies.

“Overall, I continue to expect some choppiness in the short term, but I remain optimistic and believe there are plenty of opportunities across the broader market,” he said. “I favor using any downside tests of this rally opportunistically. Don’t be seduced into thinking 2024 will be a repeat of last year where only a handful of companies dominate.”

Meanwhile, the soft landing narrative is alive and well, enabling markets to push to all-time highs while simultaneously paring Fed rate-cut expectations. Orton said the belief in a soft landing should also be reflected in a reversal of the relationship between market breadth and interest rates. For most of last year, there was an inverse relationship between the two, and it was the major decline in rates at the end of last year that coincided with a meaningful increase in market breadth.

“Fundamentals, however, are ultimately more important,” he said. “With strong economic data coupled with a near-consensus belief in a soft landing for the economy, we should be able to see the average stock take off without the support of falling rates.”

Fixed income markets are priced for strength across corporate America: The difference between investment-grade bonds and the equivalent Treasury yield was just 0.99% at the end of 2023, which was only the seventh time since 1998 the spread was below 1% at the start of a year.

The Financial Times noted that U.S. companies have sold a record $150 billion of debt since the start of the year, marking the busiest opening to the year for more than three decades.1 This should be a reason for optimism on the broader market, Orton said. As the earnings reacceleration starts to take shape outside of technology and communication services, he said this should provide a boost to a broader group of sectors and industries. The relationship that existed last year was anomalous for the broader market as well as for the higher-duration “Magnificent 7” – the seven largest stocks in the S&P 500 by market capitalization – which were largely shielded from rising rates due to a turnaround in their earnings profiles.

Also, don’t ignore the massive stockpile of cash that is still sitting on the sidelines, Orton said. Despite current expectations for a soft landing and a U.S. Federal Reserve (Fed) easing cycle, cash levels have barely budged since mid-2023. Orton said he continues to believe that retail cash will not only make its way into fixed income but also into equities as retirees reach for yield as interest rates fall. While there will certainly be some elements of FOMO – “fear of missing out” – chasing the gains across the AI complex, much of this cash is more valuation-sensitive and held by long-term investors, which Orton said could provide support for some contrarian trades in higher-quality parts of the market.

“Last year was all about a narrow subset of companies, but as the market likely broadens, I believe selectivity will be crucial to success,” Orton said. “Focus on where there are inflections in earnings and where the reacceleration in earnings per share growth will continue throughout 2024 and beyond.”

Where to look for opportunities now

Orton said he continues to have a favorable market outlook even if some choppiness in the coming weeks is expected. It has been more than 450 trading days since the last high on the S&P 500, and, absent a challenging macroeconomic backdrop, he expects the forward returns to look quite positive. The question is, Where to allocate going forward?

“If you believe, as I do, that we’ll see a broadening of the equity market, there are a few places to look,” he said. “Let me be clear in saying that leaning into a broadening market doesn’t mean eschewing what has been working: I actually believe in the durability of the AI theme.”

There are also strong secular growth drivers moving many cybersecurity names that have performed very well to start the year. But he said looking for rotation opportunities could help to balance portfolios and manage risk. So, he suggests thinking about:

-

Using downside opportunistically in small caps. One of the most interesting areas right now is small caps, Orton said. The Russell 2000® Index is still getting through a hangover from its best December on record, but if investors are more accepting of the soft landing narrative, we should start to see more life down the market cap spectrum. Flows are back to being terrible and it won’t take much to get the space to start to move, he said. With attractive valuations, Orton said he would expect earnings season to provide some upward momentum. Now that we’re largely through regional bank earnings, which he had expected to weigh on the space, maybe optimism will start to increase.

-

Opportunities in fixed income. Fed officials expect to cut rates this year, but do not seem itching to get that started in the first quarter. We finally saw some normalization in rate cut expectations last week, and this week we get an update on the Fed’s preferred price measure as well as fourth-quarter gross domestic product (GDP). While there is still likely some normalization that needs to take place, Orton said it makes sense to start buying dips on the U.S. bond market to position for the eventual Fed rate cutting cycle and to lock in favorable yields.

-

Emerging markets. While the major U.S. indices are all at record highs, Chinese equities are at record lows. “What a contrast,” Orton said. “I have been quite vocal about avoiding China and continue to see risks, so be mindful of catching a falling knife.” Stronger national balance sheets, better monetary policy, and reduced reliance on foreign funding could provide tailwinds to most emerging markets (EM), said Orton, who prefers looking at EM ex-China. A weaker U.S. dollar also supports the case to be in EM and Asia.

Often, Orton noted, investors see a market hitting an all-time high, get scared, and wonder if they should head to the sidelines for a while.

“I believe the answer is definitely not, and that plays out in the data,” he said. “If you look over the past 60 years, the 1-, 2- and 3-year periods following all-new, all-time highs in the S&P 500, returns have averaged 12%, 23% and 39%, respectively. So just because the market is sitting at a high does not mean it needs to go down.”

What to watch

It’ll be a busy week between central banks, economic updates, and earnings. The European Central Bank and Bank of Japan are among major central banks set to meet, while major data releases include corporate manufacturing outlooks in Europe and the United States as well as the preliminary fourth-quarter GDP reading. Federal Reserve members are in a blackout period ahead of the next Federal Open Market Committee meeting on Jan. 30-31, so the focus will largely be on data rather than Fed officials’ comments. On the earnings front, global chip industry heavyweights will report earnings, along with major domestic companies in consumer discretionary, communications services, and healthcare.

Risk Information:

Investing involves risk, including risk of loss.

Diversification does not ensure a profit or guarantee against loss.

Disclosures:

Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, or other expenses, which would reduce performance. Indexes are unmanaged. It is not possible to invest directly in an index. Any investor who attempts to mimic the performance of an index would incur fees and expenses that would reduce return.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature, or other purpose in any jurisdiction, nor is it a commitment from Raymond James Investment Management or any of its affiliates to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical, and for illustration purposes only. This material does not contain sufficient information to support an investment decision, and you should not rely on it in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and make their own determinations together with their own professionals in those fields. Any forecasts, figures, opinions, or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions, and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements, and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

The views and opinions expressed are not necessarily those of the broker/dealer or any affiliates. Nothing discussed or suggested should be construed as permission to supersede or circumvent any broker/dealer policies, procedures, rules, and guidelines.

Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Investing in small cap stocks generally involves greater risks, and therefore, may not be appropriate for every investor. The prices of small company stocks may be subject to more volatility than those of large company stocks.

International investing presents specific risks, such as currency fluctuations, differences in financial accounting standards, and potential political and economic instability. These risks are further accentuated in emerging market countries where risks can also include possible economic dependency on revenues from particular commodities or on international aid or development assistance, currency transfer restrictions, and liquidity risks related to lower trading volumes.

Definitions

Breadth describes the relationship between the median and the mean of a market index. When a few data outliers result in a mean that is substantially larger (or smaller) than the median of the full data set, then the performance of the entire index is being driven by a “narrow” selection of companies. An index supported by “broad” market movements is one where the median is closer to the mean.

A consensus estimate is a forecast of a public company’s projected earnings, the results of a particular industry, sector, geography, asset class, or other category, or the expected findings of a macroeconomic report based on the combined estimates of analysts and other market observers that track the stock or data in question.

Contrarian investing is term used to describe the decisions of investors who intentionally go against prevailing market trends, buying when others sell, and selling when others buy.

A credit spread is the difference in yield between a U.S. Treasury bond and another debt security with the same maturity but different credit quality. Also referred to as “bond spreads” or “default spreads,” credit spreads are measured in basis points, with a 1% difference in yield equaling a spread of 100 basis points. Credit spreads reflect the risk of the debt security being compared with the Treasury bond, which is considered to be risk-free. Higher quality securities have a lower chance of the issuer defaulting. Lower quality securities have a higher chance of the issuer defaulting.

Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company’s profitability.

Equity duration is the cash-flow weighted average time at which investors can expect to receive the cash flows from their investment in a company’s stock. Long-duration stocks include fast-growing technology companies, including those that may not pay any dividends in their early years, while short-duration stocks tend to be more mature companies with higher ratios to dividend to price.

A falling knife is a saying used in investing to describe a rapid drop in the price or value of a security or area of the market. The admonition against trying to catch a falling knife is a way of saying that an investor should wait for a price to bottom before buying something that could either rebound or lose all of its value if, for example, the company issuing the security goes into bankruptcy.

The Federal Open Market Committee (FOMC) consists of 12 members: the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents, who serve one-year terms on a rotating basis. The FOMC holds eight regularly scheduled meetings per year at which it reviews economic and financial conditions, determines the appropriate stance of monetary policy, and assesses the risks to its longrun goals of price stability and sustainable economic growth. The FOMC observes a blackout period, which begins at midnight of the second Saturday before each meeting. During the blackout periods, committee members do not make public comments about macroeconomic developments or monetary policy issues.

Fund flow is the net of all cash inflows and outflows into and out of a particular financial asset, sector, or index. It typically is measured on a quarterly or monthly basis. Investors and others look at the direction of fund flows for indications about the health of specific securities and sectors or the overall market.

Investment-grade refers to fixed-income securities rated BBB or better by Standard & Poor’s or Baa or better by Moody’s.

The Magnificent 7 refers to the seven largest stocks by market capitalization in the S&P 500 Index, as of Dec. 29, 2023. Collectively they made up more than 25% of the market capitalization of the entire index. They are Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

Market capitalization, or market cap, refers to the total dollar market value of a company’s outstanding shares of stock.

Market of stocks is a term market participants use when referring to the diversity of technical or other characteristics that may exist at any given time within the overall stock market. For example, the stock market as a whole may rise or fall on the fortunes of a small number of very large and thus very influential stocks. But within the broader market of stocks, there can be many companies with performance, risk, or opportunities that vary significantly from what market participants may find at the index level.

Mega-cap stocks are the largest publicly traded companies as measured by market capitalization. Generally, this refers to companies with market capitalizations over $200 billion.

Rotation describes the movement of investments in securities from one industry, sector, factor, or asset class to another as market participants react to or try to anticipate the next stage of the economic cycle.

Secular stocks are characterized by having consistent earnings over the long term constant regardless of other trends in the market. Secular companies often have a primary business related to consumer staples most households consistently use whether the larger economy is good or bad.

A soft landing is a cyclical slowdown in economic growth that avoids a recession. A hard landing is a significant economic slowdown or downturn, that could include a recession, following a cycle of rapid growth.

The World Economic Forum held its 2024 annual meeting on Jan. 15-19 in Davos, Switzerland, with events organized around the theme of “Rebuilding Trust.” The forum was established in 1971 as an independent not-for-profit foundation, is headquartered in Geneva, Switzerland. Its institutional culture and activities are based on the stakeholder theory, which asserts that an organization is accountable to all parts of society.

Indices

The S&P 500 Index measures change in stock market conditions based on the average performance of 500 widely held common stocks. It is a market-weighted index calculated on a total return basis with dividend reinvested. The S&P 500 represents approximately 80% of the investable U.S. equity market.

The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 7% of the total market capitalization of the Russell 3000® Index.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor, or endorse the content of this communication.

M-488172 Exp. 5/22/2024