Risk Information:

Investing involves risk, including risk of loss.

Diversification does not ensure a profit or guarantee against loss.

Disclosures

Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, or other expenses, which would reduce performance. Indexes are unmanaged. It is not possible to invest directly in an index. Any investor who attempts to mimic the performance of an index would incur fees and expenses that would reduce return.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature, or other purpose in any jurisdiction, nor is it a commitment from Raymond James Investment Management or any of its affiliates to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical, and for illustration purposes only. This material does not contain sufficient information to support an investment decision, and you should not rely on it in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and make their own determinations together with their own professionals in those fields. Any forecasts, figures, opinions, or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions, and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements, and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

Many investors consider bonds to be “risk free” investment vehicles. Historically, bonds have indeed provided less volatility and less risk of loss of capital than has equity investing. However, there are many factors that may affect the risk and return profile of a fixed-income portfolio. The two most prominent factors are interest-rate movements and the creditworthiness of the bond issuer. Bonds issued by the U.S. government have significantly less risk of default than those issued by corporations and municipalities. However, the overall return on government bonds tends to be less than these other types of fixed-income securities. Investors should pay careful attention to the types of fixed-income securities that comprise their portfolio and remember that, as with all investments, there is the risk of the loss of capital.

The views and opinions expressed are not necessarily those of the broker/dealer or any affiliates. Nothing discussed or suggested should be construed as permission to supersede or circumvent any broker/dealer policies, procedures, rules, and guidelines.

Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, disease, and regulatory developments.

Definitions

Correlation is a statistic that measures the degree to which two securities move in relation to each other.

Currency debasement refers to the lowering of the value of a currency. It can take place if a government or central bank increases the money supply in the absence of a similar increase in overall economic output. It also can refer to a reduction in the amount of precious metals used in the minting of coins.

De-dollarization refers to the movement away from the U.S. dollar as the world’s chief reserve currency. The larger the movement that takes place, the less influence the U.S. dollar will maintain with the economies of other countries.

A drawdown is a decline in the returns of a security or group of securities, as measured over a period from the peak of returns to their trough.

A hedge is an investment or investment strategy that is designed to lessen the potential for losses in other investments. The price of an investment considered to be a hedge often moves in the opposite direction of the prices of the investments being hedged.

Nominal yield, also known as the coupon rate or the nominal interest rate, is the interest rate the issuer of a bond promises to pay investors who purchase the bond. It is expressed as a percentage and is determined by dividing the total interest paid annually by the face (or par) value of the bond.

A pullback is a temporary pause or drop in the price of a security that previously had been rising.

A real interest rate, or real yield, is an interest rate that has been adjusted to remove the effects of inflation. Once adjusted, it reflects the real cost of funds to a borrower and the real yield to a lender or to an investor. A real interest rate reflects the rate of time preference for current goods over future goods. For an investment, a real interest rate is calculated as the difference between the nominal interest rate, which is not adjusted for inflation, and the inflation rate.

A 60/40 portfolio is based on a widespread investment strategy calling for a portfolio allocation of 60% equities and 40% bonds or other fixed-income securities.

Tactical trading refers to relatively short-term investing decisions made in response to expected trends or changes in the market based on fundamental and technical analysis.

Indices

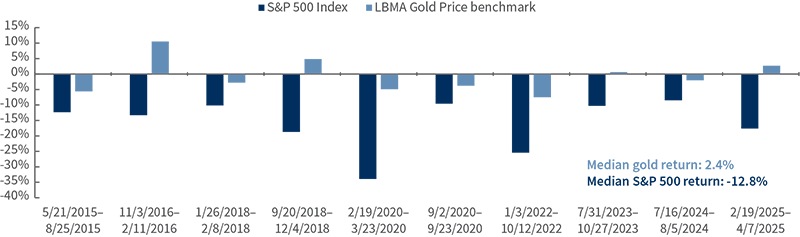

The LBMA Gold Price benchmark, administered by the ICE Benchmark Administration (IBA), reflects the price of gold on the global market as determined by twice-daily electronic auctions on the London bullion market with prices available in U.S. dollars and 16 other currencies.

The S&P 500 Index measures changes in stock market conditions based on the average performance of 500 widely held common stocks. It is a market-weighted index calculated on a total return basis with dividend reinvested. The S&P 500 represents approximately 80% of the investable U.S. equity market.

About Cougar Global Investments

Cougar Global Investments is a globally oriented macro asset-class portfolio manager that uses a disciplined portfolio-construction methodology combining macroeconomic analysis with downside-risk management. Cougar Global’s guiding belief is that the goal of investing is to generate consistent compound growth, primarily achieved by seeking to minimize loss.