Risk Information:

Investing involves risk, including risk of loss.

Diversification does not ensure a profit or guarantee against loss.

Disclosures

Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, or other expenses, which would reduce performance. Indexes are unmanaged. It is not possible to invest directly in an index. Any investor who attempts to mimic the performance of an index would incur fees and expenses that would reduce return.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature, or other purpose in any jurisdiction, nor is it a commitment from Raymond James Investment Management or any of its affiliates to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical, and for illustration purposes only. This material does not contain sufficient information to support an investment decision, and you should not rely on it in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and make their own determinations together with their own professionals in those fields. Any forecasts, figures, opinions, or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions, and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements, and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

Many investors consider bonds to be “risk free” investment vehicles. Historically, bonds have indeed provided less volatility and less risk of loss of capital than has equity investing. However, there are many factors that may affect the risk and return profile of a fixed-income portfolio. The two most prominent factors are interest-rate movements and the creditworthiness of the bond issuer. Bonds issued by the U.S. government have significantly less risk of default than those issued by corporations and municipalities. However, the overall return on government bonds tends to be less than these other types of fixed-income securities. Investors should pay careful attention to the types of fixed-income securities that comprise their portfolio and remember that, as with all investments, there is the risk of the loss of capital.

The views and opinions expressed are not necessarily those of the broker/dealer or any affiliates. Nothing discussed or suggested should be construed as permission to supersede or circumvent any broker/dealer policies, procedures, rules, and guidelines.

Definitions

Duration incorporates a bond’s yield, coupon, final maturity, and call features into one number, expressed in years, that indicates how price-sensitive a bond or portfolio is to changes in interest rates. Bonds with higher durations carry more risk and have higher price volatility than bonds with lower durations.

Nominal yield, also known as the coupon rate or the nominal interest rate, is the interest rate the issuer of a bond promises to pay investors who purchase the bond. It is expressed as a percentage and is determined by dividing the total interest paid annually by the face (or par) value of the bond.

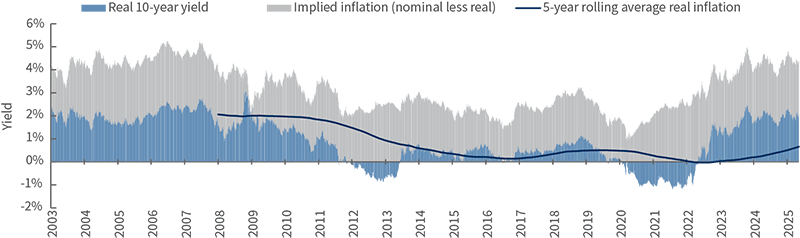

A real interest rate, or real yield, is an interest rate that has been adjusted to remove the effects of inflation. Once adjusted, it reflects the real cost of funds to a borrower and the real yield to a lender or to an investor. A real interest rate reflects the rate of time preference for current goods over future goods. For an investment, a real interest rate is calculated as the difference between the nominal interest rate, which is not adjusted for inflation, and the inflation rate.

Real returns reflect investment returns adjusted for taxes and/or inflation. Real returns are lower than nominal returns, which do not subtract taxes and inflation. Risk assets refer to investments such as equities, commodities, high-yield bonds, real estate, and currencies, where the value may rise or fall due to fluctuating interest rates, changes in credit quality, default risks, supply and demand disruption, and other factors.

A zero interest rate policy (ZIRP) is when a central bank sets its target short-term interest rate at or close to 0%, typically to expand credit and stimulate economic activity.

About Reams Asset Management

Reams Asset Management is a fixed-income management firm that implements a consistent investment process across all of its strategies. Reams’ mission is to provide the highest quality investment management expertise and unmatched client service in each of its product areas over the long term.